Understanding the need for automation in insurance documents

Why manual insurance document processes are no longer enough

Insurance companies handle a massive volume of documents every day, from policy documents and claims forms to customer communications and regulatory paperwork. Traditionally, these processes have relied heavily on manual document management, which often leads to delays, errors, and inefficiencies. Manual data entry, document sorting, and compliance checks not only consume valuable time but also increase the risk of mistakes that can impact customer satisfaction and regulatory compliance.

Growing complexity and expectations in insurance document management

As insurance products become more complex and customer expectations rise, the pressure on insurers to deliver fast, accurate, and personalized service has never been higher. Customers now expect real time updates on their claims, seamless digital interactions, and transparent policy management. At the same time, insurers must ensure that every document and process meets strict regulatory standards. This growing complexity makes manual workflows unsustainable for modern insurance business operations.

Data-driven demands and the rise of automation tools

With the explosion of data in the insurance sector, efficient document processing and data extraction have become critical. Automation tools and intelligent document management platforms are now essential for insurers aiming to streamline claims processing, improve customer experience, and maintain compliance. Automation software can handle repetitive tasks, extract key data from documents, and enable faster, more accurate decision-making. This shift towards automation insurance is not just about efficiency—it’s about transforming the entire insurance document lifecycle.

For a deeper look at how AI-driven solutions are shaping the future of document automation and customer communications, explore this insightful analysis on AI-powered document summarization.

Key technologies driving insurance document automation

Emerging Technologies Powering Document Automation

Insurance companies are rapidly adopting advanced technologies to automate document management and claims processing. These innovations are reshaping how insurers handle policy documents, customer communications, and regulatory compliance. By leveraging automation tools, insurers can process documents in real time, reduce manual intervention, and improve overall business efficiency.

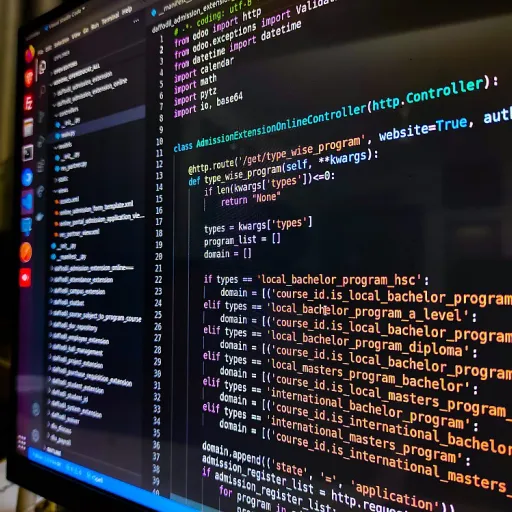

- Intelligent Document Processing (IDP): IDP platforms use artificial intelligence and machine learning to extract data from insurance documents, such as claims forms and policy documents. This technology enables accurate data extraction and classification, reducing errors and speeding up document workflows.

- Robotic Process Automation (RPA): RPA automates repetitive, rule-based tasks in document management, such as data entry and document generation. This allows insurance companies to streamline document processing and focus on higher-value activities that enhance customer experience.

- Cloud-Based Document Management Systems: Modern document management platforms offer secure, scalable solutions for storing, sharing, and retrieving insurance documents. These systems support real-time collaboration and ensure compliance with industry regulations.

- Natural Language Processing (NLP): NLP tools analyze and interpret unstructured data within insurance documents, making it easier to automate claims communication and improve customer satisfaction.

- Automation Software Integration: Integrating automation software with existing insurance systems ensures seamless document workflows, from policy issuance to claims processing. This integration reduces processing time and enhances data accuracy across platforms.

These technologies are not only transforming document automation in insurance but are also part of a broader trend in software development. For a deeper dive into how automated concepts are shaping the future of software, visit the rise of automated concepts in software development.

As insurers continue to invest in automation tools, the focus remains on improving customer satisfaction, ensuring regulatory compliance, and optimizing document workflows. The adoption of these key technologies lays the foundation for more efficient, customer-centric insurance operations.

Challenges faced during automation adoption

Overcoming Integration and Data Quality Barriers

Insurance companies often face significant hurdles when implementing automation in document management. One of the main challenges is integrating new automation tools with legacy systems. Many insurers rely on older platforms for policy and claims processing, making it difficult to connect modern automation software seamlessly. This can slow down the transition to automated workflows and limit the potential benefits of document automation.

Ensuring Regulatory Compliance and Security

Another critical concern is maintaining regulatory compliance and data security. Insurance documents contain sensitive customer information, so any automation solution must meet strict compliance standards. Automated document processing must ensure that data extraction, document generation, and claims communication adhere to industry regulations. Failing to do so can result in legal penalties and loss of customer trust.

Managing Change and User Adoption

Adopting automation in insurance document management also requires a cultural shift within the organization. Employees accustomed to manual processes may resist new workflows, fearing job displacement or struggling to adapt to new systems. Training and clear communication are essential to help staff embrace automation tools and understand their role in improving customer experience and satisfaction.

Handling Data Quality and Consistency

Automation relies heavily on accurate data. Poor data quality or inconsistent document formats can disrupt automated document processing, leading to errors in claims, policy documents, and customer communications. Insurance companies must invest in data cleansing and standardization before deploying intelligent document management solutions.

Balancing Speed with Accuracy

While automation promises faster document workflows and real-time processing, there is a risk of sacrificing accuracy for speed. Automated data extraction and document generation tools must be carefully calibrated to ensure that business-critical information is processed correctly. Continuous monitoring and quality checks are necessary to maintain high standards in document management.

For insurers looking to streamline their document management and ensure robust security, exploring top software solutions to streamline security questionnaires can provide valuable insights into best practices and technology options.

Benefits realized through automated document workflows

Unlocking Efficiency and Accuracy in Insurance Workflows

Insurance companies that have embraced automation tools for document management are seeing significant improvements across their operations. By automating document processing, insurers can handle large volumes of insurance documents, such as policy documents and claims forms, with greater speed and precision. This shift from manual to automated workflows reduces the risk of human error and ensures that data extraction from documents is consistent and reliable.Enhancing Customer Experience and Satisfaction

Automated document management platforms enable real-time processing of claims and policy updates. Customers benefit from faster claims communication and quicker resolution times, which directly impacts customer satisfaction. Automation software streamlines customer communications by generating accurate, timely responses and policy documents, helping insurers deliver a more responsive and transparent service.Supporting Regulatory Compliance and Security

Insurance document automation also plays a crucial role in maintaining regulatory compliance. Automated systems track and archive documents according to industry standards, reducing the risk of non-compliance. Intelligent document management tools ensure that sensitive customer data is handled securely, meeting both internal and external compliance requirements.Reducing Costs and Freeing Up Resources

By minimizing manual intervention, insurance companies can lower operational costs and reallocate staff to higher-value business activities. Automation insurance solutions reduce the time spent on repetitive tasks, such as document generation and data entry, allowing teams to focus on more strategic initiatives. This not only boosts productivity but also supports business growth.- Faster claims processing and improved accuracy

- Enhanced customer experience through real-time updates

- Streamlined compliance and secure data management

- Lower operational costs and better resource allocation

Best practices for successful automation projects

Establishing Clear Objectives and Metrics

Successful automation in insurance document management starts with defining clear business objectives. Insurers should identify which document processes—such as claims processing, policy document generation, or customer communications—will benefit most from automation. Setting measurable goals for efficiency, accuracy, and customer satisfaction helps track progress and demonstrate value.Ensuring Data Quality and Integration

Automation tools rely on high-quality data for accurate document processing and data extraction. Insurance companies should invest in data cleansing and ensure seamless integration between existing systems and new automation platforms. This reduces manual errors and supports real-time document workflows.Prioritizing Regulatory Compliance

Insurance document automation must comply with industry regulations. Building compliance checks into automated workflows ensures that policy documents, claims communication, and customer data are handled securely. Regular audits and updates to automation software help maintain regulatory compliance as requirements evolve.Focusing on Change Management and Training

Transitioning from manual to automated document management requires effective change management. Insurers should provide comprehensive training for staff on new automation tools and intelligent document management systems. Open communication about the benefits—such as reduced processing time and improved customer experience—can increase adoption and minimize resistance.Continuous Improvement and Feedback Loops

Automation is not a one-time project. Establishing feedback loops with users and stakeholders allows insurance companies to refine document automation workflows over time. Monitoring key metrics, gathering input from claims teams, and updating automation tools ensures ongoing improvements in efficiency and customer satisfaction.- Define clear business goals for automation projects

- Invest in data quality and seamless system integration

- Embed regulatory compliance into document workflows

- Support staff with training and change management

- Regularly review and optimize automation processes

The future outlook for insurance document automation

Emerging Trends Shaping Tomorrow’s Insurance Document Automation

The insurance sector is entering a new era where automation is not just about efficiency but also about delivering smarter, more responsive services. As insurers continue to digitize, several trends are set to redefine how insurance document management evolves.- AI-Powered Data Extraction: Intelligent document processing tools are becoming more advanced, enabling real time data extraction from a wide range of insurance documents. This shift reduces manual intervention, accelerates claims processing, and enhances accuracy in policy document management.

- Seamless Integration Across Platforms: Modern automation software is designed to connect with existing insurance systems, allowing for unified workflows. This integration supports end-to-end document automation, from policy generation to claims communication, improving both compliance and customer experience.

- Personalized Customer Communications: Automation tools are now capable of tailoring customer communications based on individual policyholder data. This not only boosts customer satisfaction but also ensures regulatory compliance by delivering the right information at the right time.

- Cloud-Based Document Management: Cloud platforms are making it easier for insurance companies to store, access, and process documents securely. This flexibility supports remote work, faster document processing, and more robust disaster recovery strategies.

- Enhanced Regulatory Compliance: With evolving regulations, insurers are leveraging automation to ensure that every document and workflow meets compliance standards. Automated audit trails and real time monitoring help reduce risk and maintain trust with regulators and customers alike.