Understanding accounts payable transformation in the digital era

The shift from manual to digital in accounts payable

In recent years, businesses have seen a significant transformation in how they manage accounts payable. Traditionally, these processes relied heavily on manual data entry, paper invoices, and time-consuming approvals. This manual approach often led to delays, errors, and missed payment discounts, impacting both cash flow and operational efficiency. With the rise of digital transformation, organizations are now embracing automation software to streamline invoice processing and payment workflows.

Why automation is at the core of payable transformation

Automation is not just a buzzword; it’s a necessity for modern financial operations. Automated systems reduce the need for repetitive manual processes, allowing finance teams to focus on higher-value tasks. By digitizing invoice processing and integrating real-time data, companies can achieve faster payment cycles, improve compliance, and gain better visibility into their financial data. Payable automation also supports early payment initiatives, which can lead to cost savings and improved supplier relationships.

Business drivers behind accounts payable modernization

Several factors are pushing businesses to rethink their payable processes. The demand for operational efficiency, the need to manage increasing invoice volumes, and the pressure to maintain compliance with evolving regulations all play a role. Digital transformation in accounts payable is not just about technology; it’s about reimagining how financial processes support overall business goals. This shift is also influencing organizational culture, as finance teams adapt to new roles and responsibilities in a more automated environment.

For a deeper look at how enterprise platforms are enabling this transformation, explore our insights on enterprise platform innovation.

Key technologies driving change in accounts payable

Automation and AI: The New Backbone of Payable Processes

Accounts payable transformation is being driven by a wave of automation and artificial intelligence. Businesses are moving away from manual processes, which are time-consuming and error-prone, towards automated systems that streamline invoice processing and payment workflows. Automation software can capture invoice data, match purchase orders, and route approvals in real time, reducing the need for manual data entry and minimizing the risk of human error.

- Invoice processing: Automated systems extract and validate invoice data, accelerating processing times and improving accuracy.

- Payment automation: Digital transformation enables businesses to schedule payments, capture early payment discounts, and optimize cash flow management.

- Machine learning: AI algorithms identify patterns in financial data, flagging anomalies and supporting compliance efforts.

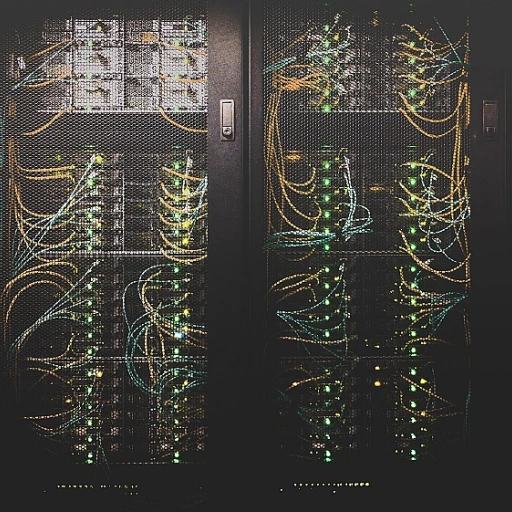

Cloud-Based Platforms and Integration

The shift to cloud-based platforms is another key trend in payable automation. These solutions offer scalability, remote access, and seamless integration with other business systems. By connecting accounts payable with procurement, ERP, and financial reporting tools, organizations achieve greater operational efficiency and visibility across their processes.

For industries like construction logistics, specialized platforms such as Command Alkon TrackIt are shaping the future of software by enabling real-time data sharing and process automation tailored to sector-specific needs.

Enhancing Efficiency and Cost Savings

Automated accounts payable systems deliver significant cost savings by reducing manual labor, lowering error rates, and enabling better control over payment timing. Businesses benefit from improved cash flow, fewer late payments, and the ability to take advantage of early payment discounts. As digital transformation continues, the focus remains on increasing efficiency and supporting compliance in every step of the payable process.

Integration challenges and solutions for modern businesses

Overcoming Data Silos and System Fragmentation

One of the biggest hurdles in accounts payable transformation is integrating new automation software with existing business systems. Many organizations still rely on legacy platforms, manual processes, and fragmented data sources. This creates data silos, making it difficult to achieve real time visibility into financial operations and invoice processing. As companies move toward digital transformation, the need for seamless integration between payable automation tools and core financial systems becomes critical for operational efficiency.

Strategies for Streamlined Data Flow

Modern businesses are adopting several strategies to address integration challenges in their payable processes:

- API-driven connectivity: Automation software with robust APIs enables smooth data exchange between accounts payable systems, ERP platforms, and payment providers. This reduces manual data entry and supports automated invoice processing.

- Cloud-based platforms: Migrating to cloud solutions allows for easier updates, better scalability, and improved access to real time financial data. Cloud integration also supports remote teams and enhances compliance.

- Data mapping and transformation: Advanced tools can map and standardize data from multiple sources, ensuring consistency across payment and invoice processes. This is especially important for organizations managing high volumes of invoices and payments.

- Machine learning for exception handling: Automated systems can use machine learning to identify and resolve discrepancies in invoice data, reducing the need for manual intervention and speeding up the payable process.

Connecting Financial Systems for Advanced Analytics

Integrating accounts payable automation with analytics platforms unlocks new opportunities for cost savings and process optimization. For example, connecting ERP systems like NetSuite to data warehouses such as Snowflake enables advanced analytics on payment cycles, cash flow, and early payment discounts. This integration empowers finance teams to make data-driven decisions and improve overall efficiency. For a practical guide on this topic, see how to connect NetSuite to Snowflake for advanced data analytics.

Best Practices for Successful Integration

- Conduct a thorough audit of current payable processes and systems before selecting automation tools.

- Prioritize solutions that offer strong compliance features and support for digital payments.

- Invest in training for finance teams to ensure smooth adoption of new automated systems.

- Monitor integration performance regularly to identify bottlenecks and optimize workflows.

By addressing integration challenges head-on, businesses can unlock the full potential of accounts payable transformation, reduce manual workloads, and achieve greater operational efficiency.

The impact on finance teams and organizational culture

Shifting Roles and Responsibilities in Finance Teams

The transformation of accounts payable through automation and digital processes is significantly changing the daily work of finance teams. Manual processes like data entry, invoice processing, and payment approvals are being replaced by automated systems. This shift allows finance professionals to focus less on repetitive tasks and more on strategic activities, such as analyzing financial data and optimizing cash flow. As a result, teams are experiencing greater operational efficiency and can contribute more directly to business growth.

Adapting to New Workflows and Technologies

With the adoption of payable automation and digital transformation, finance teams must adapt to new workflows. Learning to use automation software and understanding real time data processing are now essential skills. This transition often requires upskilling and ongoing training to ensure that staff can manage automated accounts payable processes effectively. The move from manual to automated invoice and payment processes can be challenging, but it ultimately leads to improved accuracy, faster processing times, and the ability to capture early payment discounts.

Fostering a Culture of Continuous Improvement

As organizations embrace accounts payable transformation, there is a growing emphasis on fostering a culture of continuous improvement. Finance teams are encouraged to regularly review and refine their processes, leveraging data insights from automation tools to identify bottlenecks and areas for cost savings. This proactive approach not only supports compliance and risk management but also helps businesses stay competitive in a rapidly changing digital landscape.

Collaboration Across Departments

The evolution of accounts payable processes is also breaking down traditional silos within organizations. Automated systems enable better collaboration between finance, procurement, and IT departments. By sharing real time data and streamlining invoice approvals, businesses can ensure smoother payment cycles and stronger supplier relationships. This cross-functional teamwork is essential for maximizing the benefits of digital transformation in accounts payable.

Security and compliance in the evolving accounts payable landscape

Safeguarding Data and Ensuring Regulatory Alignment

As accounts payable transformation accelerates through automation and digital processes, security and compliance have become central concerns for businesses. The shift from manual processes to automated systems means sensitive financial data and payment information are now handled in real time, often across multiple platforms and cloud environments. This evolution brings both opportunities for efficiency and new risks that must be managed carefully.Key Security Risks in Automated Payable Processes

The adoption of automation software for invoice processing and payment workflows introduces several security challenges:- Data breaches: Digital transformation increases the volume of financial data exchanged electronically, making robust encryption and access controls essential.

- Fraud prevention: Automated systems must be designed to detect anomalies in payment processes, such as duplicate invoices or unauthorized payment requests.

- Third-party risks: Integration with external vendors and platforms can expose businesses to vulnerabilities if partners do not maintain strong security standards.

Compliance in the Age of Digital Transformation

Regulatory requirements for accounts payable are evolving alongside technology. Businesses must ensure that their payable automation solutions support compliance with standards such as GDPR, SOX, and local tax regulations. This means:- Maintaining accurate audit trails for all payment and invoice processing activities

- Implementing controls for data entry and storage to protect personal and financial information

- Ensuring timely reporting and documentation for regulatory bodies

Best Practices for Secure and Compliant Payable Automation

To balance efficiency with risk management, organizations should:- Adopt machine learning tools that flag suspicious transactions in real time

- Regularly review and update access permissions for accounts payable systems

- Train finance teams on compliance requirements and security protocols

- Leverage automation software that provides end-to-end encryption and detailed logging

Looking ahead: the future of accounts payable in software development

Emerging Trends in Payable Automation

The future of accounts payable is being shaped by rapid advances in automation and digital transformation. As businesses continue to move away from manual processes, the adoption of automation software is accelerating. This shift is not just about reducing data entry or streamlining invoice processing. It’s about reimagining the entire payable process to drive operational efficiency, cost savings, and better cash flow management.

Real-Time Data and Intelligent Decision Making

One of the most significant changes on the horizon is the use of real-time data in accounts payable systems. Automated systems are increasingly leveraging machine learning to analyze financial data, detect anomalies, and recommend actions such as early payment discounts. This enables finance teams to make smarter, faster decisions and optimize payment processes for maximum benefit.

Seamless Integration and End-to-End Processing

Future-ready payable automation platforms are focusing on seamless integration with other business systems. This end-to-end approach ensures that invoice processing, payment approvals, and compliance checks happen within a unified workflow. The result is fewer errors, reduced processing time, and a more transparent audit trail for compliance purposes.

Enhanced Security and Compliance Measures

As digital payments and automated accounts payable processes become the norm, security and compliance are top priorities. Modern solutions are embedding advanced security protocols and real-time compliance monitoring to protect sensitive financial data and ensure adherence to regulations. This reduces risk and builds trust across the organization.

Continuous Improvement and Adaptation

- Automation will continue to evolve, with AI and machine learning driving smarter, more adaptive payable processes.

- Businesses will prioritize solutions that offer flexibility, scalability, and the ability to respond to changing regulatory environments.

- Finance teams will shift from manual, transactional tasks to more strategic roles, focusing on analysis and process improvement.

Ultimately, the transformation of accounts payable is setting a new standard for efficiency and innovation in financial operations. As organizations embrace automated systems and digital processes, they are better positioned to achieve cost savings, improve cash flow, and unlock new opportunities for growth.

-large-teaser.webp)